A lot is written about the trendy, flexible perks of the gig economy. Sure, it can be “liberating,” if you have a husband or wife who is a high-powered lawyer or doctor and you can “gig” with abandon between sessions of binge-watching “Orange is the New Black,” but for those of us in single-income households, these new “alternative work arrangements” are nothing short of a nightmare that keeps us on the constant brink of financial disaster.

The gig economy is even harder on people over 50; we’re less likely to be able to slide into consecutive contract positions as effortlessly as workers who are in their 20s or 30s.

Last week, my latest “gig” ended prematurely, because the multi-billion dollar medical device company that had hired me just three months earlier decided to dump all the contractors in my business unit. This was the “first wave” of their third reorg in six months.

This was supposed to be a one year assignment…so much for honoring our contract. I didn’t see this one coming, because several managers had sent my manager unsolicited compliments about my work and I really liked it there.

I actually thought I had a shot of staying on and eventually becoming an FTE (full-time employee). My hiring manager even dangled that possibility during my interview. Huh…foolish mortal. At the end of the day, I was just another anonymous blip on some overcompensated executive’s spreadsheet.

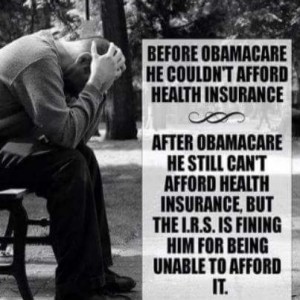

Health care or wealth care?

This scenario was déjà vu all over again for me; the gig I had before this one — this time with a multi-million dollar health care system that is owned by a multi-billion dollar global chemical company (chew on that alliance for a while) — ended exactly the same way after only four months. Again, I was told this was a one year assignment, and again, I was caught under the wheels of a budget-cutting reorg.

It’s not just small- or medium-sized budget-conscious businesses that treat their workforce like the girlfriend they like to sleep with but will never marry, its billion dollar health care conglomerates, and equally flush Wall Street and Silicon Valley mega-employers.

If they can’t afford to hire people at a decent wage and provide benefits, who can? Of course they can; they just don’t. And they have our government’s blessing to treat us like disposable napkins…wipe and toss.

After a lifetime of steady, salaried middle-management employment, it’s hard to find yourself unprotected as an independent contractor. Gone are jobs that pay a living wage that increase with time for work well done, humane work hours, job security, health insurance, pensions and other traditional benefits.

We no longer have rights or unions to protect us and keep us steadily employed. In fact, the globalist-owned media has been waging a successful propaganda campaign to demonize unions for years, while our politicians (beginning with Ronald Reagan) have been simultaneously gutting the rights of unions and union members.

This is a tragedy, especially since gig workers can go weeks (or months) without work and we live in fear of getting sick or injured, because if we can’t work, we can’t earn money. Frankly, I could use a strong union right about now.

And when we do find work, it’s usually through temp agencies we’ve never heard of (some are offshore). They place us and pay us (while taking a piece of every hour we work). All we can do is hope that, since they have our social security number and all of our proprietary information, that they don’t sell our identity to some cyber criminal or exploit it themselves.

What’s to stop them? I’m not aware of any protections in place. Again, this is not a priority for our “representatives” in government.

The curse of NAFTA

The table was set for our growing transient workforce with the passage of NAFTA (the North American Free Trade Agreement). We have Bill, and yes, Hillary Clinton to thank for this travesty. NAFTA gave greedy corporate chieftains access to unlimited cheap, offshore labor and officially placed the middle class American worker on the extinction list.

The post-NAFTA war against the middle class began when companies started getting rid of our pensions; phase two involved outsourcing tech support and customer service to countries that provided cheap offshore labor for U.S.-based companies.

Eventually, with the assistance of bought-off members of Congress, greedy corporate titans started bringing in foreign workers through H1-B visas. The rationale was that there weren’t enough qualified people in this country to fill the many “jobs” they were creating.

This is a lie, as the recent Disney IT employee fiasco proves (they let go of their U.S. IT team, imported foreign workers to fill the positions at lower wages, and forced the displaced workers to train their replacements or forfeit their severance packages).

Other companies have, and continue, to follow Disney’s example. Mainstream media has (surprisingly) covered this issue, and still not a peep from Congress or Obama.

Elizabeth Warren did recently mention the need to address this issue, but to date, she hasn’t introduced any legislation to remedy the situation, so who cares what she thinks? She’s paid to fix these things. So, get to steppin’ Betty.

To make things worse, our taxes are used to provide these companies with subsidies. So, essentially, we’re paying for our own funeral.

More than half of all jobs created since 1995 were non-standard jobs, which include part-time workers, contract workers or self-employed people, according to a report published in May 2015 by the Organization for Economic Cooperation and Development (OECD).

While our politicians hammer us with wedge issues like gun control, whine endlessly about the “humanitarian” need to let in an an endless stream of unvetted refugees and pat themselves on the the back for enforcing the “Dreamer Act,” they ignore the plight of their constituents, the American worker.

The American middle class is dying, and while Congress and Obama administer the last rites, it’s becoming obvious that there won’t be anyone left to attend the funeral.

At my most recent “gig,” I worked with some people who had been employed for anywhere from six to 18 years. The only three people “hired” within the past year, including me, were contractors…not one FTE.

One of the “vested” employees often griped about the threat of her bonus being sub-par this year. She knew that I had a solid career as a salaried management employee until recently and that, despite being good at my job, I couldn’t find a similar role in this economy.

She sympathized with my circumstances, but I could tell she didn’t think she was at risk of experiencing a similar fate…after all, what happened to me only happened to “other” people, not her. I wish I could tell her that she’s right, but I know better. The reality is that if we all don’t push our representative to fix this now, my gig worker misery will have a whole lotta company soon.